maricopa county tax lien auction

ARIZONA - Maricopa County Tax Lien Sale. The state can foreclose on State liens held at least 7 years.

Making Sense Of Maricopa County Property Taxes And Valuations

Please refer to bidding rules for deposit instructions.

. The above parcel will be sold at Public Auction on Monday March 14 2022 at 1100 am at. Where and how it works a tax lien sale is a method many states use to force an owner to pay unpaid taxes. Property taxes that are delinquent at the end of December are added to any previously uncollected taxes on a parcel for the Tax Lien Sale.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Maricopa County AZ at tax lien auctions or online distressed asset sales. CP holders may begin to subtax 2021 liens. 27 rows State Liens have been auctioned at each tax sale but did not sell.

Visit Arizona tax sale to register and participate. Select the township range and section to search for and. A list of the liens will be published in mid-January.

Property taxes that are delinquent at the end of December are added to any previously uncollected taxes on a parcel for the Tax Lien Sale. The sale of Maricopa County tax lien certificates at the Maricopa County tax sale auction generates the revenue Maricopa County Arizona needs to continue to fund essential services. People buy tax liens for two reasons.

The Online Tax Lien Sale will be open approximately two weeks prior to the sale for parcel viewing new bidder registration and bidding. Ad HUD Foreclosed Is the Fastest Growing Most Secure Provider of Foreclosure Listings. Flood Control District of Maricopa County 2801 W.

The tax on the property is auctioned in open competitive bidding based on the least percent of interest to be received by the investor. Register for 1 to See All Listings Online. Day of the Online Auction March 2.

Assignable liens are available for purchase by assignment at 16 interest rate. These listings may be used as a general starting point for your research. Do not include city or apartmentsuite numbers.

Bidding is online only and will begin when the list is published and close on February 5 2019. Maricopa County AZ currently has 16859 tax liens available as of March 14. For more assistance with your research please speak with an Information or Reference Services staff member.

Please click on the tabs below depending on what type of auction you are interested in. Redeemed liens have been paid off by their owners. 21 rows A cashiers check in the amount of 1825000 made out to Maricopa County is required to be an eligible bidder.

First to obtain ownership of a property through foreclosing the lien. In order for the State to return these parcels to the tax rolls through a tax-deeded land sale Maricopa County must first offer the parcels at a public auction in which anyone may bid on the parcels. Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More.

Ad Buy Tax Delinquent Homes and Save Up to 50. SELECTED LAWS REGULATIONS AND ORDINANCES. Second half 2021 taxes are delinquent after 500 pm.

In Arizona if property taxes are not paid the County Treasurer will sell the delinquent lien at public auction. Ad Compare foreclosed homes for sale near you by neighborhood price size schools more. The Tax Lien Sale provides for the payment of delinquent property taxes by an investor.

In Maricopa County Arizona the first half of real estate property taxes is due on October 1 and are delinquent after December 31st of each year. The auction bid site will be available in mid-January and information on the auction is located on the. TAX LIEN SALES Below is a partial listing of materials available on this topic in the Superior Court Law Library.

Maricopa County AZ currently has 13 tax liens available as of March 9. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest. The tax on the property is auctioned in open competitive bidding based on the least percent of interest to be received by the investor.

We also offer RealTDA for online Tax Deed Applications and RealTDM for Tax Deed Management solutions. The website will be open to the general public approximately 2-3 weeks prior to the Tax Sale date. Detailed listings of foreclosures short sales auction homes land bank properties.

The tax on the property is auctioned in open competitive bidding based on. Durango St Phoenix Arizona 85009. Or second to obtain a high rate of interest on the amount invested.

Delinquent tax notices are sent to taxpayers for 2021 taxes. RealTaxLien for all Online Tax Lien Auctions and RealForeclose for all Online Foreclosure Auctions Tax Deed Auctions and Sheriff Sale Auctions. Ad Compare tax foreclosed homes for sale near you by neighborhood price size more.

January 2 2020. Our online auction products are as follows. Enter the Assessor Parcel Number APN to search for and then click on Go.

There are currently 11375 tax lien-related investment opportunities in Maricopa County AZ including tax lien foreclosure properties that are either available for sale or worth pursuing. State CP sales begin May 2. Some counties may have left over tax lien certificates that they sell outside of the auction.

Preview and bidding will begin on January 26 2021. Bidders must be registered and have their initial deposit submitted via Wire or ACH though the Real Auction web site one day prior to the sale in order to participate. Enter the property owner to search for and then click on Go.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Maricopa County AZ at tax lien auctions or online distressed asset sales. The Tax Lien Sale provides for the payment of delinquent property taxes by an investor. The Maricopa County Treasurers Tax Lien Web application allows you to monitor your CP Buyer account with Maricopa County.

Enter the address or street intersection to search for and then click on Go. The next delinquent property tax lien auction for Maricopa County will be on February 5 2019 for the 2017 tax year. Detailed listings of foreclosures short sales auction homes land bank properties.

After advertisement and a public auction where bids are received the Board of Supervisors will convene a public meeting and may vote to sell the parcels to the highest. The Tax Lien Sale will be held on February 9 2021. HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings.

The Tax Lien Sale provides for the payment of delinquent property taxes by an investor.

Property Tax Rate Changes In Maricopa County Greater Phoenix Arizona

Maricopa County Approves 3 4 Billion Budget With Reduced Property Tax Rate Ktar Com

Delinquent Property Tax Lien Sale Overview Arizona School Of Real Estate And Business

Eastmark No 1 Eastmark No 2 And Cadence Cfd City Of Mesa

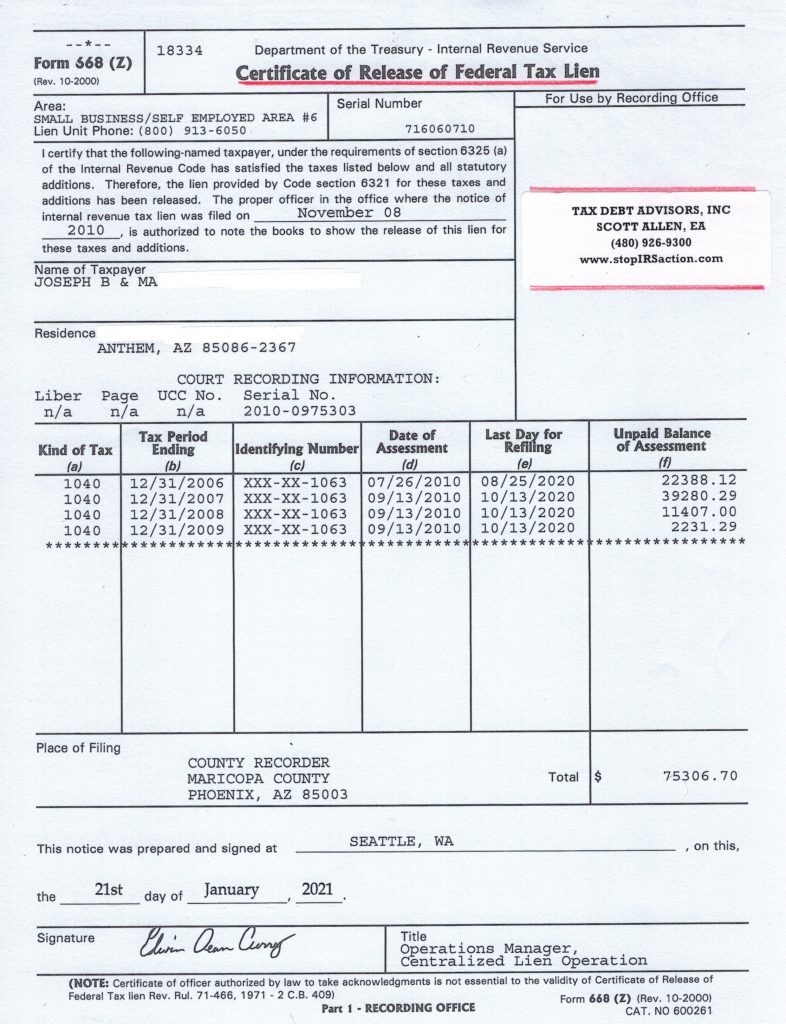

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors

How Do I Pay My Taxes Maricopa County Assessor S Office

How Do I Pay My Taxes Maricopa County Assessor S Office

Making Sense Of Maricopa County Property Taxes And Valuations

Bonds Overrides Property Tax Calculator

Maricopa County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Residential Commercial Rentals City Of Tempe Az

Maricopa County Arizona Federal Loan Information Fhlc

Maricopa County Assessor S Office

Maricopa County Assessor S Office